Here's What You Need To Know Before You Start Selling To Customers In The EU

Learn about GDPR and Import VAT

Get ready to sell to the EU with these tips on GDPR and Import VAT

Europe, a vibrant market boasting over 500 million consumers, presents a lucrative opportunity for e-commerce stores based outside the continent. However, venturing into European markets requires adherence to stringent regulations, notably the General Data Protection Regulation (GDPR) and specific tax policies. Understanding these complex laws is paramount for non-European businesses to establish successful e-commerce operations in the region.

General Data Protection Regulation (GDPR)

Enforced since May 2018, the GDPR is a pivotal aspect of data privacy in the European Union (EU). Its primary goal is to empower individuals with control over their personal data. For eCommerce stores, irrespective of their geographical location, if they're dealing with the personal data of EU residents, compliance with GDPR is mandatory.

Consent: At the heart of GDPR lies the principle of consent. Online retailers must request user consent in clear, straightforward language before collecting or processing personal data. This means that pre-ticked checkboxes or implicit consent mechanisms are not valid. Consent must also be easy to withdraw.

Data Minimization and Purpose Limitation: Businesses should only collect data necessary for a specific purpose and cannot use the data for other purposes without further consent.

Right to Access and Erasure: European consumers have the right to request access to their personal data. They can also request for their data to be deleted (the 'right to be forgotten').

Data Protection Officer (DPO): If the core activities of the eCommerce store involve 'regular and systematic monitoring of data subjects on a large scale', appointing a DPO becomes mandatory.

Data Breaches: In the event of a data breach, businesses are obliged to report to the relevant supervisory authority within 72 hours. Individuals affected by the breach should be notified without undue delay.

Failure to comply with GDPR can result in hefty fines, up to €20 million, or 4% of the global turnover of the previous financial year, whichever is higher.

European Tax Policies

Value Added Tax (VAT): VAT is a consumption tax that applies to goods and services within the EU. For non-European eCommerce businesses selling to European customers, understanding the rules of VAT is crucial. Since July 2021, the EU implemented a new VAT system, removing the previous distance-selling thresholds. Instead, a universal threshold of €10,000 now applies across the EU. For sales below this threshold, VAT can be charged at the rate of the retailer's country. However, for sales above €10,000, VAT should be applied based on the customer's location.

Import Duty and Customs: Products imported into the EU may be subject to customs duties. The duty rates depend on the nature of the products and their country of origin. It's crucial for eCommerce stores to classify their products correctly under the Combined Nomenclature (CN) system to ensure accurate duty calculations.

One-Stop-Shop (OSS): The OSS system simplifies VAT obligations for eCommerce businesses by allowing them to register for VAT, file returns, and make payments in one EU member state, regardless of the destination of their goods within the EU. This mechanism significantly simplifies VAT compliance for non-EU online retailers.

Double Taxation Treaties (DTTs): Many countries have DTTs with EU member states, aimed at preventing the same income from being taxed twice. Non-European eCommerce stores should consult these agreements to understand their tax obligations better.

Entering the European market offers exciting prospects for eCommerce businesses. However, a thorough understanding of GDPR and tax policies is crucial to ensure smooth operations and consumer trust. If in doubt, it's advisable for businesses to seek professional advice to navigate these complex regulations successfully. This investment will not only help in compliance but also in harnessing the vast potential that the European market offers.

Now that you've read up on the requirements, here's what you can do on your store to comply with said requirements (if your business is outside of the EU and you'd like to sell to customer within the EU).

1. Log in to your store and click Settings, followed by Features.

2. Next check the box next to EU General Data Protection Regulation (GDPR) Compliance then click Save Settings.

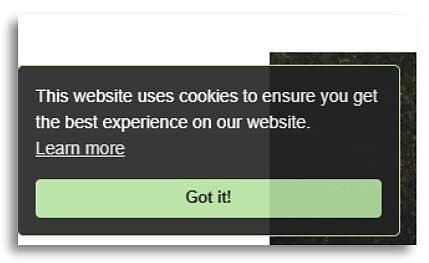

If you'd like to have an overlay appear at the bottom of your page like the screenshot below, you can get a code here and link it to your Pricacy Policy page. They have a free basic plan for a single policy. After you get the code, pass it to us and we'll install it for you.

For more information regarding GDPR, click here. For more information on EU Import VAT click here.